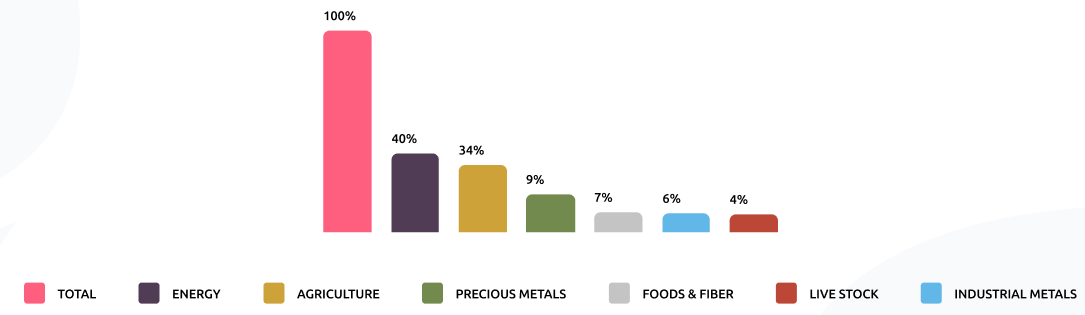

Our 2022 to 2030 targets in all segments at the turning point of the industry:

NCO as a physical trader uses logistics and price capabilities to source, store, and ship commodities. NCO sources offtake agreements, tanker cargo, chartering, owned or leased storage facilities, and critical consumer contracts. as a resource-heavy trader, NCO focuses on core energy operations and observes bank regulatory issues and driving exits...

Our precious metals desk focuses on the gold, silver, and platinum sectors.

NCO trading desks deal with copper, aluminum, lead, tin, nickel, manganese, and raw materials

We trade physical most of the agricultural products, and we hedge your price risk in the expanding global agricultural marketplace with benchmark products such as wheat, corn, and soybean futures and options. Our trading desks execute event-driven trades with precision using liquid, actively-traded agricultural contracts. We can trade coffee, sugar, cotton, and frozen orange juice.

We source trade and agricultural transport products such as soybeans, cocoa, coffee, cotton, sugar, rice, wheat, and soft commodities such as lentil beans. We trade futures contracts. We work with manufacturers, blenders, distributors, traders, and end-users of dry bulk fertilizers and chemicals, assisting with production services and support.

Our risk management experts will look at your trading operation and identify risks in areas including:

- Transportation planning

- Tracking

- Documentation (import/export permits)

- Quality assessment and testing – our experts and laboratories are available

- Quantity/volume measurement – our experts are available worldwide

- Fraud

- Supply chain

Livestock trading has continuously increased over the last 20 years, 1990 and 2018, the volume of meat exports increased by more than threefold (327%). However, crop products still dominate agricultural trade. The proportion of meat in agricultural exports has fluctuated substantially between 5.6% and 7.5% for the last 20 years. An increase in the consumption of livestock products and change in trade policies or economic liberalization has increasingly facilitated a rise in livestock product trade Development in transport such as long-distance cold-chain shipments has made possible the trade and movement of perishable crops, livestock products, and feedstuffs over long distances. Although the bulk of livestock production is consumed within the country of origin, the continuous rise in consumption of livestock products and the increasing degree of openness to trade has made it possible for some countries to specialize in exporting certain livestock products. Trading patterns of meat exports, revealing that beef exports from Oceania and Latin America, pork from Europe and North America, poultry from Latin and North America, and mutton from Oceania have steadily increased in the last ten years. On a volume basis, Brazil has been the largest beef exporter globally since 2017, followed by Australia, India, and the United States of America (USA). Over the past decade, India's rise in beef exports is a new phenomenon fueled by rising developing country demand. Foot and mouth disease status is a significant driver of global trade patterns in beef (and lamb).

| Unit | Equivalent to | |

|---|---|---|

| gigajoule (GJ) | J 09 joules | |

| 0.95 million Btu | ||

| 0.95 thousand cubic feet of natural gas at J000 Btu/cf | ||

| 0.165 barrels of oil | ||

| 0.28 megawatt hour of electricity | ||

| gigawatt hour (GW.h) | 106 kW.h | |

| 3 600 Gj | ||

| 0.0036 PJ | ||

| kilowatt hour (kW.h) | 0.0036 GJ | |

| megawatt hour (MW.h) | 3.6 GJ | |

| terawatt hour (TW.h) | 10! kW.h | |

| 3.6 P] | ||

| 1 cubic metre ( 3//pentanes plus) | 35.1 7 GJ | |

| J cubic metre (m!) (light) | 38.5J Gj | |

| 1 cubic metre (m!) (heavy) | 40.90 Gj | |

| thousand cubic feet (Mel} | J.05 G) | |

| miilion cubic feet (MMcf) | 1.05 TJ | |

| billion cubic feet (Bcf} | 1.05 PJ | |

| trillion cubic feet (Tcfj | 1.05 EJ | |

| J tonne (t) (anthracite) | 27.70 GJ | |

| 1 tonne (t) (biruminous) | 27.60 GJ |

| Prefixe | Equivalent to | |

|---|---|---|

| k | (kllo) | 10! |

| M | (mega) | 10! |

| G | (giga) | 409 |

| T | (tera) | 1012 |

| P | (peta) | 1015 |

| E | (exa) | 1018 |

| From | To | Multiply by |

|---|---|---|

| Metres (m) | Feet | 3.2808 |

| Kilometres (km) | Miles | 0.621 |

| Hectares (ha) | Acres | 2.471 |

| Kilograms (kg) | Pounds | 2.205 |

| Cubic metres (m!) | barrels (oil or natural gas liquids) | 6.292 |

| Cubic metres (m!) | cubic feet of natural gas (@ 14.73 psia and 60°F} | 35.301 |

| Litres (L) | US gallons | 0.265 |

| Litres (L) | imperial gallons | 0.220 |

| Imperial Gatlons | US gallons | 1.201 |

| Barrels (bbl) | US gallons | 42.0 |

| Barrels (bbl) | imperial gallons | 34972 |

| Metric Tonnes (t) | Pounds | 2204.6 |

| Kilo Neters/Litre | Miles/Gallon | 2.825 |

| Gigajoules (GJ) | Million British Thermal Units | 0.95 |

| Abbreviation | Description | |

|---|---|---|

| bbl | Barrels | |

| b/d | Barrels per day | |

| m3 | Cubic Metre | |

| m!/d | Cubic metres per day | |

| Mb/d | Thousands barrels per day | |

| MMb | Million barrels | |

| MMb/d | Million barrels per day | |

| MW | Megawatt | |

| kW.h | Kilowatt hour | |

| MW.h | Megawatt hour | |

| GW.h | Gigawatt hour | |

| Tw.h | Terawan hour | |

| Bcf | Billion cubic feet | |

| Bcf/d | Billion cubic feet per day | |

| Btu/cf | British thermal units per cubic feet | |

| cf | Cubic feet | |

| cubic metre | ||

| 3/d | Cubic metres per day | |

| Mel | Thousand cubic feet | |

| MMBtu | Million British thermal units | |

| MMcf | Million cubic feet | |

| MMcf/d | Million cubic feet per day | |

| Tcf | Trillion cubic feet |